Category: Uncategorized

-

You need cash. Like, yesterday. Maybe payroll is coming up, inventory needs restocking, or an unexpected opportunity just landed in your lap. But here's the problem: your credit score isn't exactly sparkling, and traditional banks move at the speed of a sloth on sedatives. Sound familiar? You're not alone. Thousands of business owners face this…

-

You've probably heard the horror stories. Business owners drowning in debt. Daily payments sucking their accounts dry. The "quick fix" that turned into a financial nightmare. So when someone mentions merchant cash advances (MCAs), your guard goes up. And honestly? That's a smart instinct. But here's the thing, MCAs aren't inherently evil. They're a financial…

-

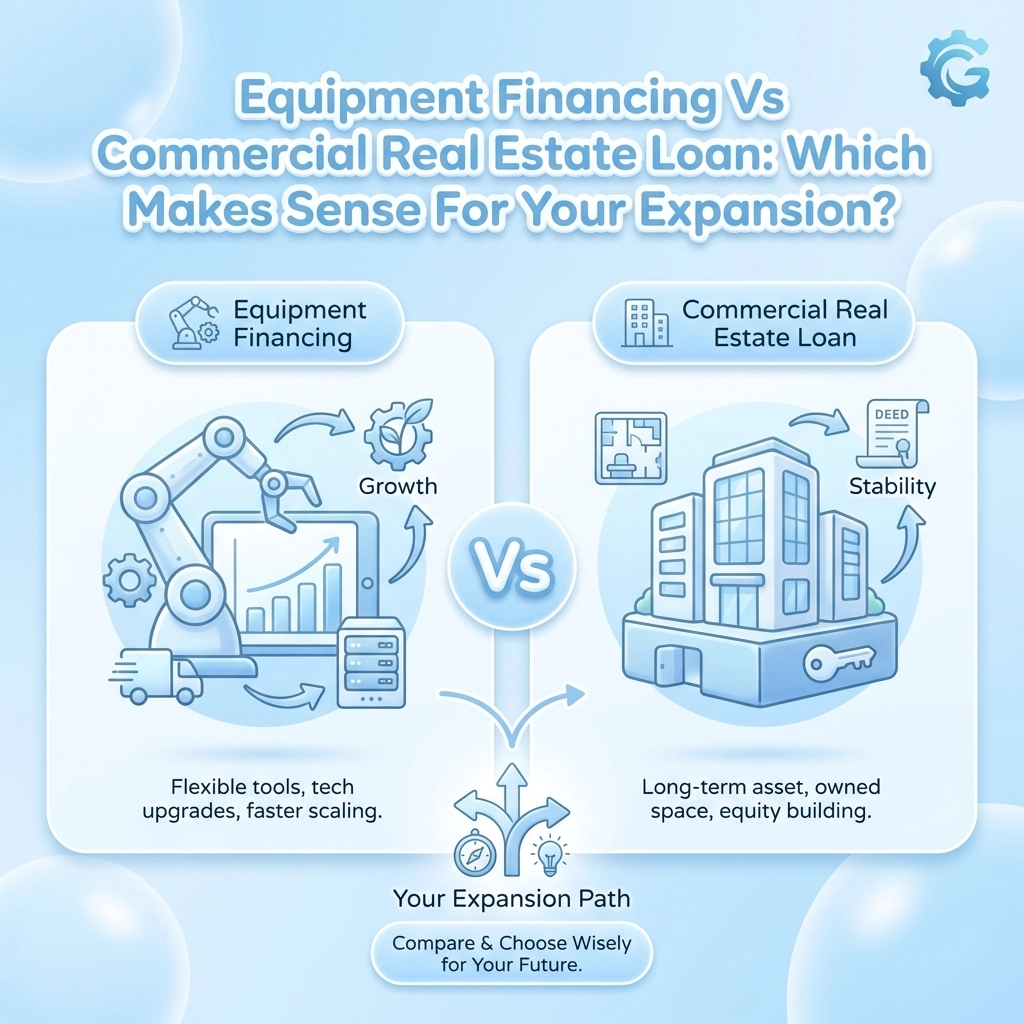

You're ready to grow. The demand is there, your team is ready, and you can practically see the next level of your business on the horizon. But here's where it gets tricky: should you invest in new equipment to scale operations, or is it time to lock down a physical location that gives you room…

-

You've made the resolutions. Hit the gym January 2nd. Meal prepped on Sunday. Maybe even downloaded that meditation app everyone's been talking about. But here's the thing, your business needs a fresh start too. Just like your body needs fuel to crush those fitness goals, your business needs working capital to seize opportunities in 2026.…

-

You've probably heard that getting green business funding means drowning in government paperwork and waiting months for approval. Not true. While some sustainability programs do require extensive documentation, there are plenty of streamlined options that can get you funded fast, even if your credit isn't perfect. The key is knowing which funding paths match your…

-

Starting a business is tough enough without worrying about cash flow. You've got a brilliant idea, the drive to succeed, and maybe even your first customers lined up. But here's the reality: 82% of small businesses fail due to cash flow problems, not lack of demand. The good news? You don't need perfect credit to…

-

You're staring at two completely different funding paths, and frankly, both seem confusing. SBA loans promise low rates but demand perfect paperwork. Revenue-based financing offers speed but costs more. Which one actually makes sense for your business right now? Here's the straight truth: neither option is universally better. The right choice depends on your cash…

-

Your credit score isn't perfect. You need working capital fast. And traditional banks keep saying no. Here's the reality: over 50 different funding solutions exist for businesses with less-than-perfect credit. Most business owners never hear about them because banks don't offer them, and finding the right match takes insider knowledge. You're about to discover exactly…

-

You just got the rejection email. Again. Your business needs funding now, but traditional banks are treating you like a credit risk they won't touch with a ten-foot pole. Here's the good news: bank rejection doesn't mean you're stuck. While banks take weeks or months to make decisions (and often say no anyway), alternative lenders…

-

You've probably been told that getting equipment financing means weeks of waiting, mountains of paperwork, and crossing your fingers that some loan officer in a back office likes your credit score. That's the old way of thinking, and frankly, it's keeping you from the funding you need to grow your business. Here's what's really happening…